Introduction

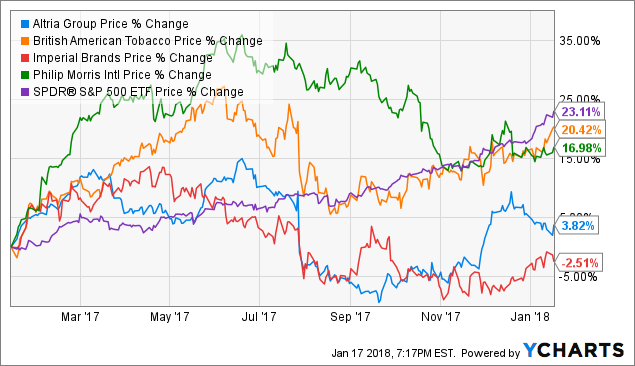

While the S&P 500 (SPY) has surged higher during the last 12 months, shares in Altria (MO) and Imperial Brands (OTCQX:IMBBY) have been left behind. The shares of their two large competitors, British American Tobacco (BTI) and Phillip Morris (PM), have performed better. However they too have fallen short of the S&P 500. Undoubtedly the FDA’s nicotine announcement has weighed down their share prices. My views on this are similar to those of Height Securities. While I believe this requires monitoring, it is not a reason to totally avoid the sector. Furthermore I believe their shares are getting overlooked as people turn more bullish on the global economy and focus their attention on cyclical growth companies.

MO data by YCharts

MO data by YChartsSince my preference is to buy shares when they are out of favor, this underperformance has piqued my interest in the tobacco sector, particularly in the two companies whose shares have lagged the most, Altria and Imperial Brands. These companies offer the characteristics that I seek for a safe investment, stable earnings with an attractive dividend yield while also being immune to many possible economic and geopolitical "black swan" events. My reasons for seeking this type of investment is to counteract the strong cyclical nature of my oil and gas investments. Furthermore, the tobacco company would need to be in a strong financial position thereby not undermining their other safe characteristics. In this article I will analyze the financial aspects of Altria and Imperial Brands from a dividend investor’s perspective.