In recent years United States Steel Corp. (NYSE:X) has been focused on surviving a deep industry downturn, not investing for the future. Now that the industry is turning around United States Steel is playing catch up on the investments it should have made, unlike industry leader Nucor Corp. (NYSE:NUE) which kept spending throughout the downturn. U.S. Steel's management is largely to blame for that, and a new team at the helm isn't an instant solution.

The surprise announcement

When U.S. Steel announced first-quarter results in April, investors were shocked by what they heard. First, on the bottom line, it reported a loss of $1.03 a share. By contrast, Nucor's earnings of $1.11 a share were up materially from the $0.27 it earned in the prior year. And Steel Dynamics (NASDAQ:STLD) posted a profit of $0.82 a share, up from $0.26. To be fair, U.S. Steel's results were an improvement from its loss of $2.32 in Q1 2016, but investors were expecting more with even then CEO Mario Longhi noting the improving market conditions.

IMAGE SOURCE: GETTY IMAGES

The reason given for the unexpectedly weak result was basically that the company needed to invest in its business for the future. For example, the CEO said, "The execution of our asset revitalization program and the continued implementation of reliability centered maintenance practices are critical to achieving sustainable improvements in our operating performance and costs." Further, he noted: "This remains a cyclical industry and we will not let favorable near-term business conditions distract us from taking the outages we need to revitalize our assets in order to achieve more reliable and consistent operations, improve quality and cost performance, and generate more consistent financial results."

Neither Nucor nor Steel Dynamics made statements like that. In fact, it sounded more like U.S. Steel was only starting to get serious about making long-term investments in its business -- after an industry upturn had started. The logical takeaway of that was that U.S. Steel might miss out on benefiting from the improving steel market while it played catch-up on capital investments it should have been making all along. That rightfully upset many investors and led to an over 20% decline in the stock price.

A look at the numbers

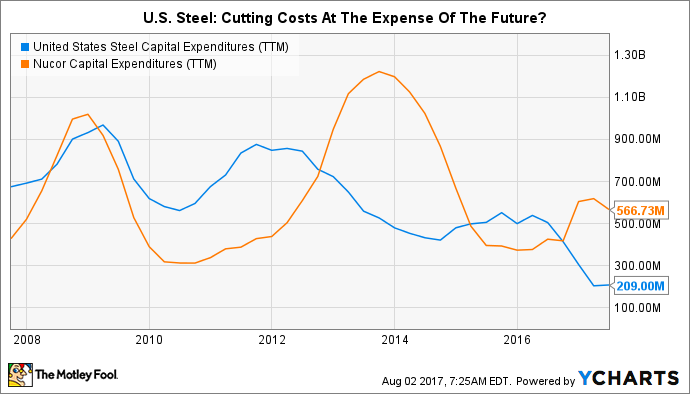

On this score, a quick look at the trends in capital investment between Nucor and U.S. Steel is telling. Nucor's capital spending has ebbed and flowed over the past decade, with a couple of spikes for big projects like new facilities to make direct reduced iron ore and upgrades at other facilities to produce higher margin steel products. Beyond the spikes, however, Nucor's capital investment seems to have remained at about the same level. In other words, it continued to invest for the future.

X CAPITAL EXPENDITURES (TTM) DATA BY YCHARTS

U.S. Steel's capital investment trends are more than a little different. Although there were a couple of bumps over the past 10 years, none was as material as the spikes at Nucor for big projects. And, overall, capital investment at U.S. Steel trended lower and lower through the decade. You can see where investors would be concerned about the future after the CEO's Q1 statements.

No easy fix

Not long after Q1 earnings were announced, Mario Longhi stepped down as CEO. The tenure of new CEO David Burritt started off on a solid note, as the company recently reported Q2 earnings of $1.48 a share -- sharply better than both Q1's unexpectedly deep loss and Q2 2016's loss of $0.32 a share. The market was pleased with the result and pushed the steel maker's shares higher on a day when rivals including Nucor and Steel Dynamics, were falling.

But little that Burritt has done yet had anything to do with creating that result. And his comments on the quarter included statements like, "Our investment in our facilities and our people continues to increase." If the capital investment trend over the past decade is any indication, U.S. Steel will have no choice but to keep boosting investment in its business to play catch-up. In other words, nothing has really changed.

Consider a different team

U.S. Steel is an iconic company, and I believe it is strong enough to make it through the sector's ups and downs. However, right now it appears to be poorly positioned for the future. The reason for that is management's decision to pull back on the spending that would have prepared the steel mill for the current upturn. It has plans to fix that, but those plans are too late to allow U.S. Steel to fully benefit from the steel rebound. investors would be better off investing in a company like Nucor, where management didn't sacrifice the future to save some money in the present.

10 stocks we like better than United States Steel

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now… and United States Steel wasn't one of them! That's right -- they think these 10 stocks are even better buys.