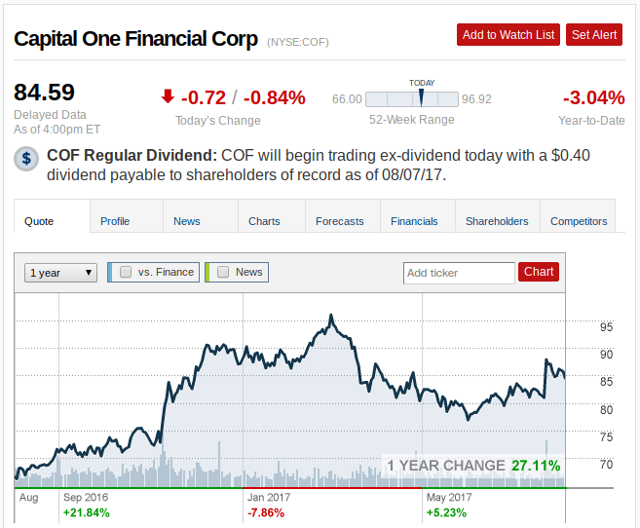

The banking sector has shifted into the center of the market’s focus this earnings season and the recent moves in Capital One Financial Corp. (NYSE:COF) have caught many investors by surprise. The stock surged 8.6% in one day after its latest earnings release and when we are dealing with valuation changes of this magnitude it is only natural to be somewhat skeptical over the validity of the move. But when we look at the factors supporting the upside surprise and Capital One’s lack of exposure in recently problematic areas of the banking industry, we can see that there is still good upside potential even after the initial rallies. Long positions in COF can be taken while the stock is trading above 81.05, as any decline through here would alter the stance and signal a period of stalling in COF.

When making investor assessments in Capital One, it is important to understand how the company differs from other major industry competitors like Bank of America Corp. (BAC) and Goldman Sachs Group, Inc. (GS). Recent news headlines for both of these banks have highlighted deficiencies in trading volumes and the effect this has had on generalized profitability in core businesses. Capital One does not rely on trading businesses as a central revenue generator, so this is not something that will need to be factored into the equation when making projections about likely earnings growth in coming quarters.